Zero To Hero Challenge: CPI Slaughterhouse

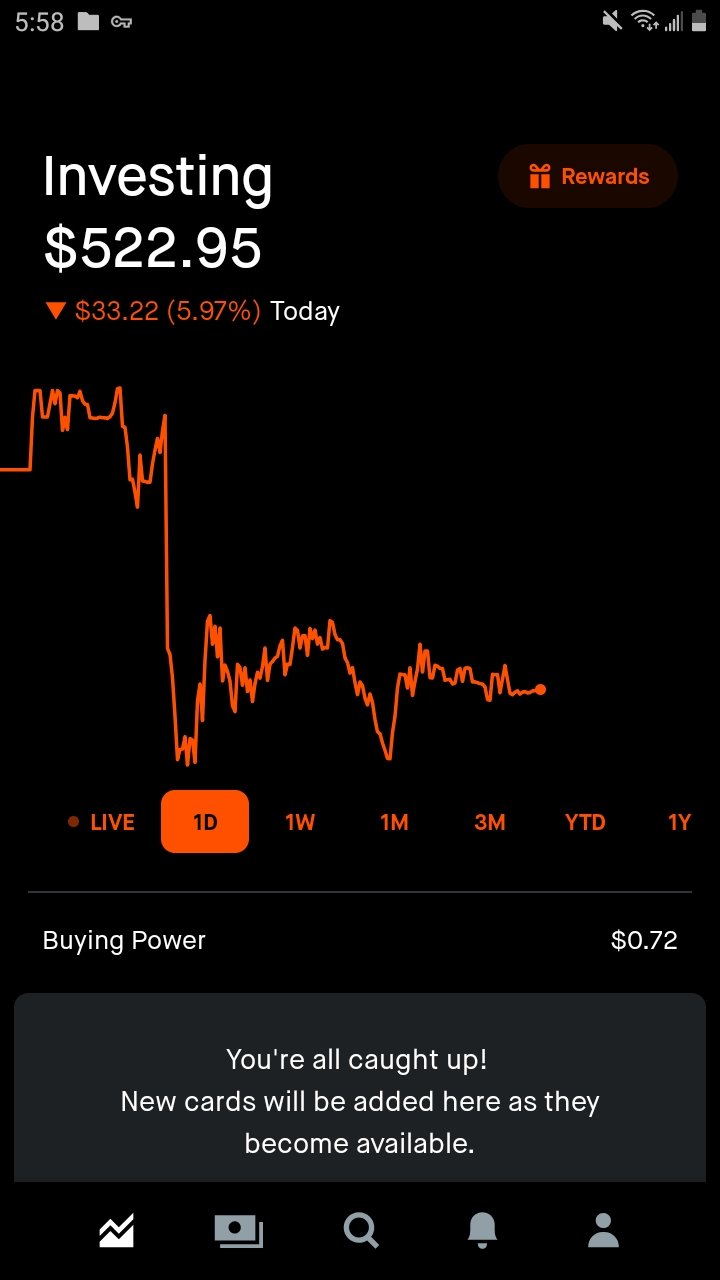

Why did the market get absolutely slaughtered today? Many are scratching their heads wondering what happened and I am here to fill you in.

Early this morning the Consumer Price Index inflation report was released. This data is a measure of the average change in prices over time, paid by average consumers on a basket of goods and services.

Today the inflation came in at 8.3% YoY increase, which was slightly higher than expectes. Experts were hoping to see it closer to 8.0% to signal a greater policy effect by the federal reserve.

Instead, the high numbers were extremely concerning to institutions which sold off just about everything that wasn't nailed down this morning. Crypto was not spared as Bitcoin saw double digit losses from $22.8k down below $20k at one point.

Buyers finally stepped in at the last minute to give some price support but not before the stock market shed over $1.6 Trillion in value.

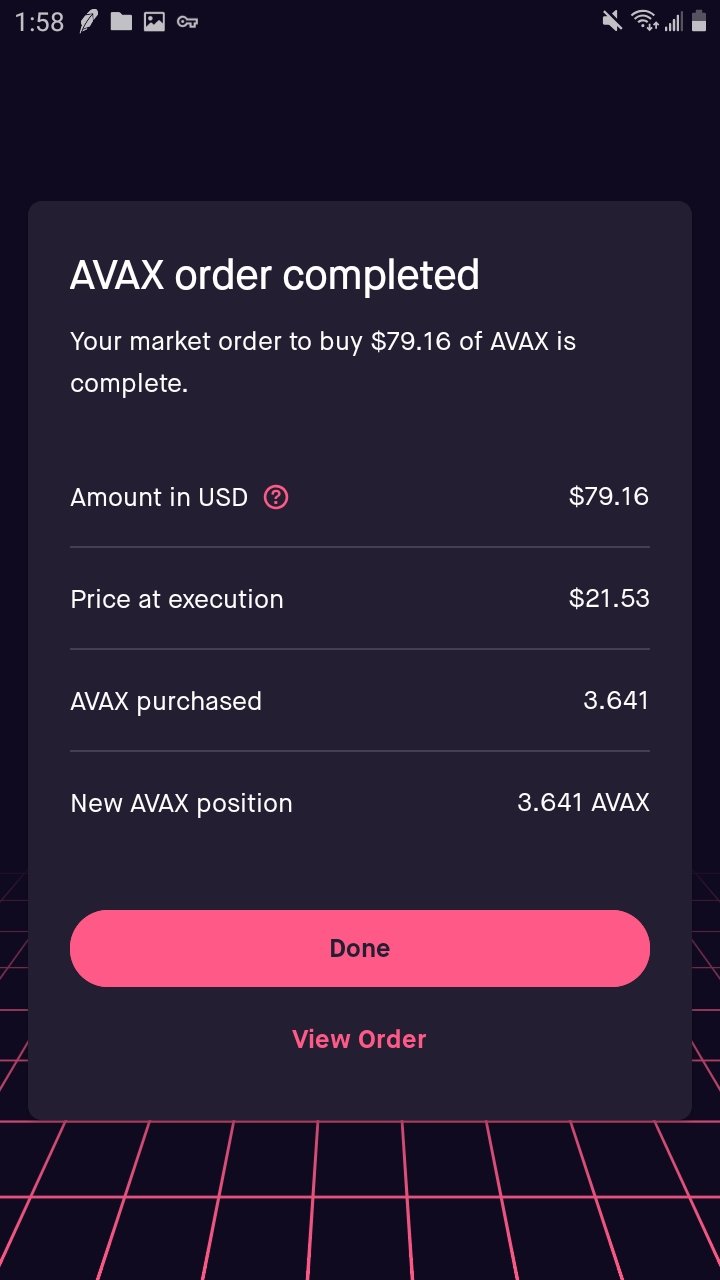

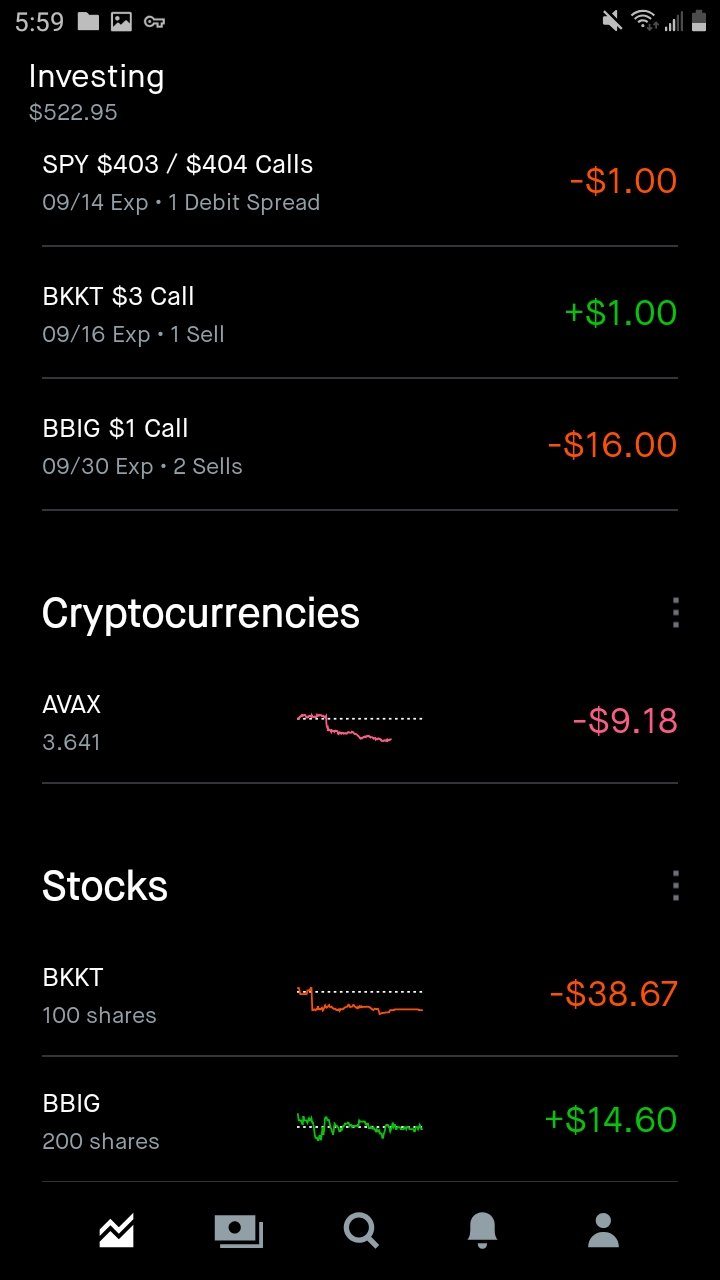

Last night I used my spare buying power on Robinhood to buy AVAX, and am now down slightly on that position.

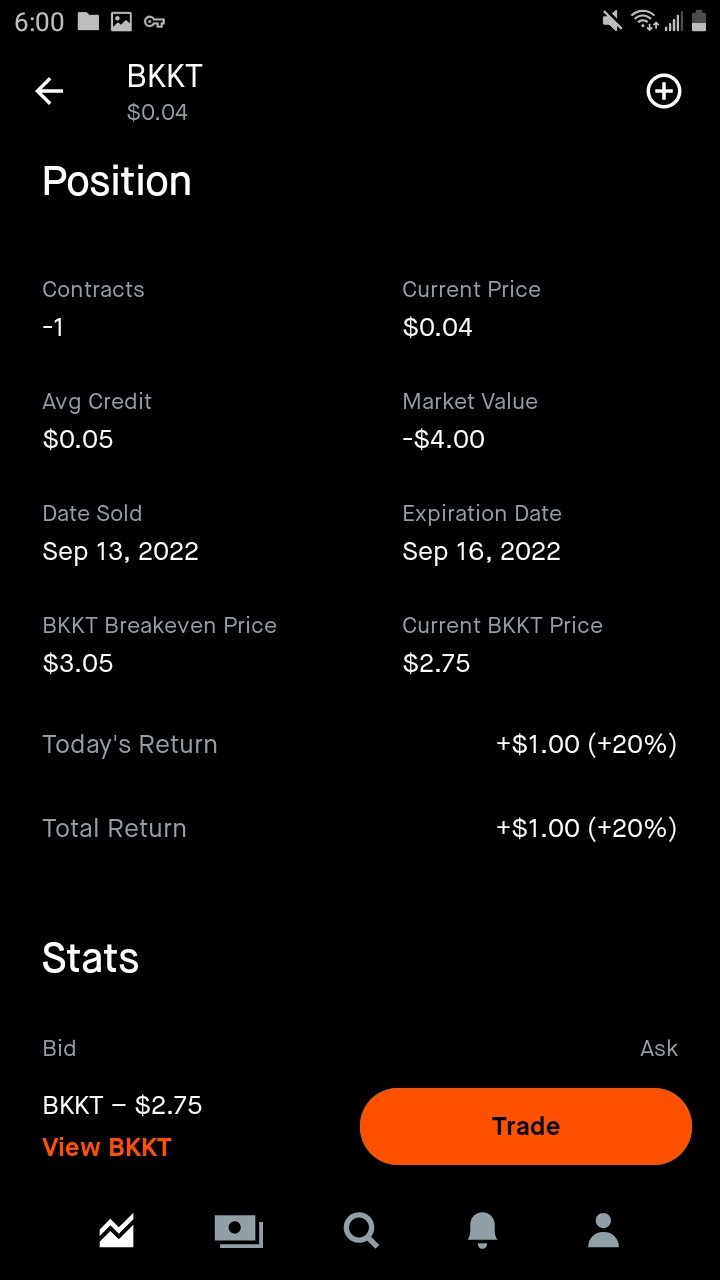

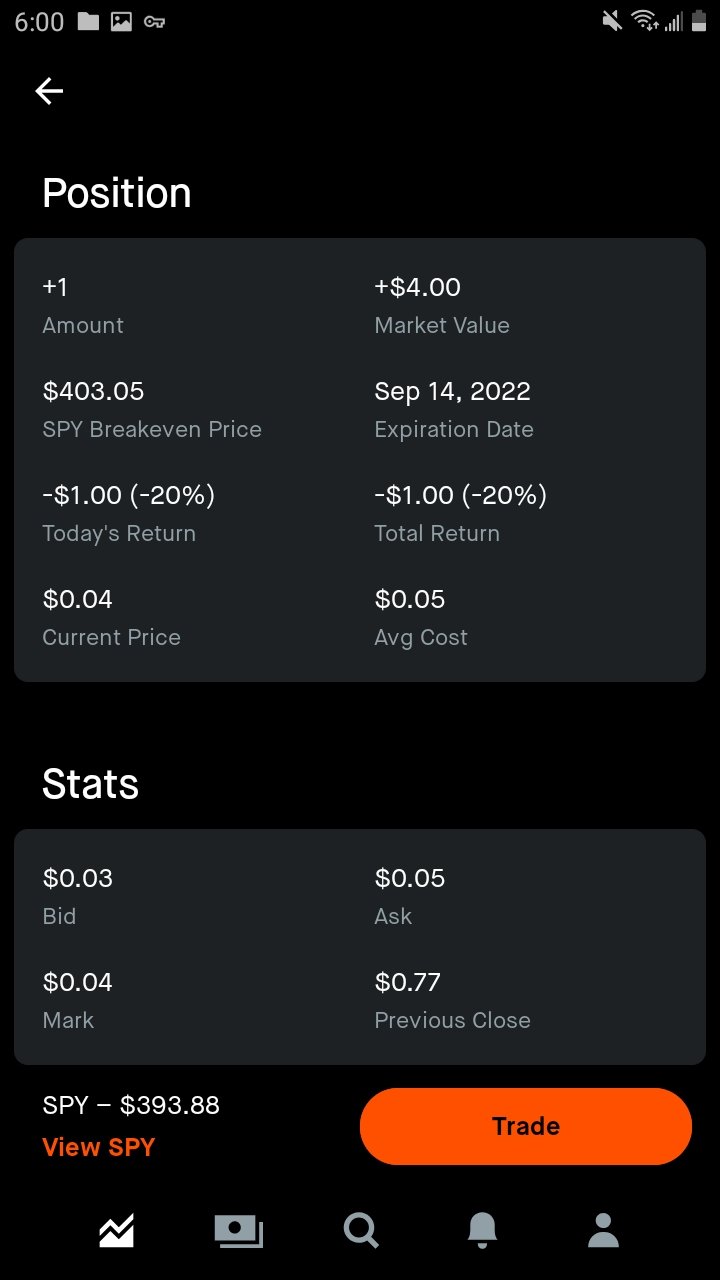

This morning I opened one $3 covered call in BKKT, collecting $5 in premiums. I then spent that $5 on a $403/$404 call debit spread on the SPY. If the SPY rallies tomorrow past $404 I will get paid 20:1 on this contract!

All of my current positions, showing gains or losses here.

Not bad for the worst day of 2022, allegedly. My portfolio survived without too much damage amazingly.

As long as BBIG stays above $1 I am looking to get called away on Sept 30th and then begin The Wheel strategy, by writing cash covered puts.

Bakkt should remain below $3 through Friday and I will get my shares unlocked and returned over the weekend.

Dear @hotsauceislethal, we need your help!

The Hivebuzz proposal already got important support from the community. However, it lost its funding a few days ago and only needs a bit more support to get funded again.

May we ask you to support it so our team can continue its work?

You can do it on Peakd, ecency, Hive.blog or using HiveSigner.

https://peakd.com/me/proposals/199

Your support will be really appreciated.

Thank you!