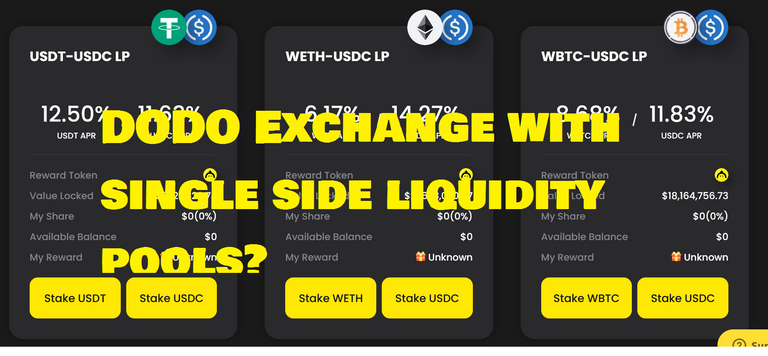

LeoFinance - Liquidity Pools With Single Assets Investing?

As my dive into Defi gets deeper and deeper there are more interesting products out there for investment. The most common one would be a liquidity pool. Liquidity pool includes two tokens split in 50 to 50 in $ value that must be placed in the pool to earn reward fees. There are hundreds if not thousands of protocols across many different blockchains. Yet today I will talk about one that is on the Ethereum blockchain that has liquidity pools but an additional feature I have never seen before and think it has a lot of potential moving forward in the defi world. The additional feature I am getting at is investing in a pool with only one asset rather than both assets of a pool. We will get to it in this post.

DoDo Exchange

The snapshot is golden when we look deeper into investing in one side of a liquidity pool. https://app.dodoex.io/liquidity?network=mainnet will offer this option for investors. This may be revolutionary in its own right and I will explain why?

Buying and Selling Crypto

On a centralized exchange when we place an order to purchase a crypto we typically have our assets locked into the trade without earning any additional rewards. Instead when a trade is executed we pay the exchange a fee and in turn have a different token we traded from our original crypto. For instance have USDT and trade it for BTC. While the order is in place my USDT is locked until it hits bid price and once that happens order gets executed and buyer gives seller the USDT while seller gives BTC to buyer. Meanwhile of the trade is a limit order the assets USDT and BTC are locked by both buyer and seller respectively. The locked assets do not earn holders anything.

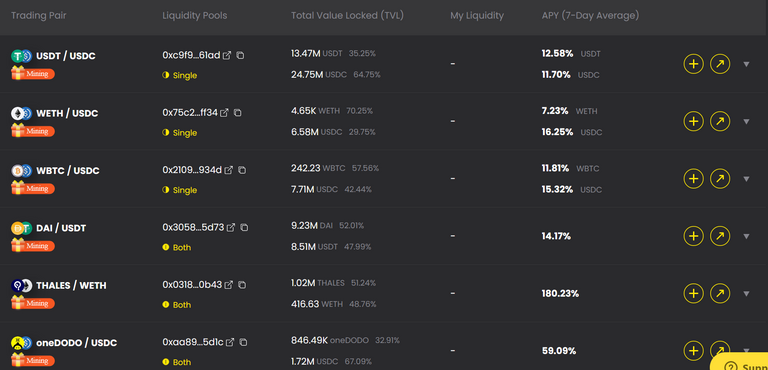

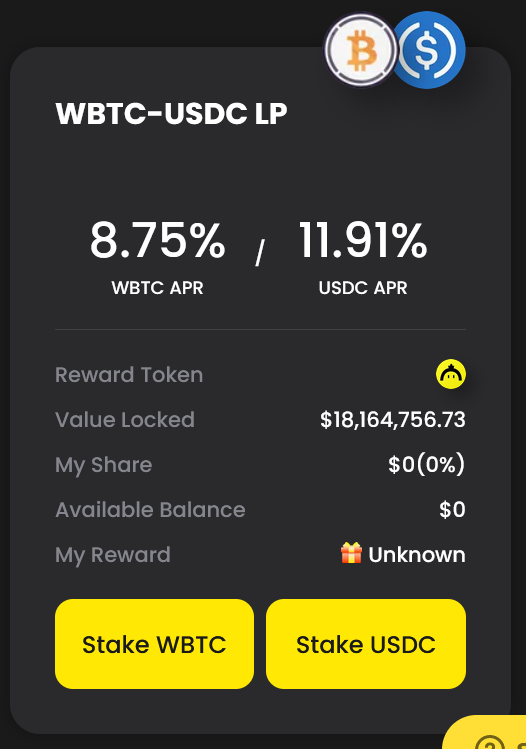

DoDo Liquidity Pools

DoDo exchange has allow investors the opportunity to earn interest for providing liquidity in one of the two tokens in a pool. Snap shot above investors can earn 8.75% APR if they place wBTC in the pool. This is any amount of wBTC the investor wishes to place. Same goes on the opposite side where investors can earn 11.91% APR if they place USDC in the pool.

Two major benefits occur with the single token investment in pools. The first is user can earn rewards without having to swap out of their assets! For instance if I wanted to invest in wBTC side but do not want to buy USDC they don't have to make the swap. They simply invest in the wBTC pool and will earn rewards that way.

The second benefit of single sided pool investing is the potential of buying and selling their current holding at a steady pace. By investing into wBTC : USDC pool and lets give the example of only investing in wBTC if BTC price continue to soar I will automatically have a smaller stake of BTC when I withdraw. However I have a USDC stake earned because I have invested what is a liquidity pool. This is the impermanent lose that liquidity pools have. If BTC prices drop I add more wBTC overall. While BTC going up or down I am earning daily reward from the APR DoDo offers to partaking in the pool.

Conclusions

One sided liquidity pool investing allows us to limit having to do swaps and incur fees. In addition earn daily rewards while also having the potential to trade higher or lower of an asset. In the case of wBTC : USDC pool if I speculate that the price of BTC will drop and want to buy more at lower prices I would provide wBTC holding into the pool. This will earn me daily rewards and in the mean time be trading in the liquidity pool waiting for wBTC to fall in price and me potentially getting more BTC out of the liquidity pool when I withdraw.

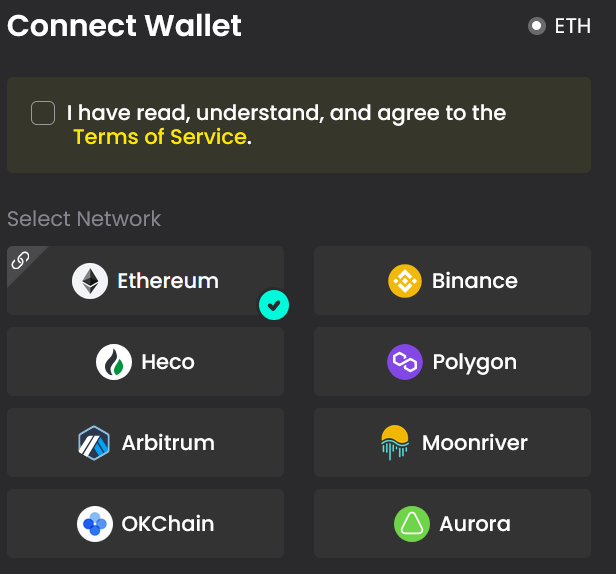

This is what I see as the future of trading where people essentially interact with the pool for direct trades rather than just swapping assets in pools. In case you were wondering DoDo Exchange is also available on these other blockchains:

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

This is pretty good find, I always like onesided pools, this is a ETH pool?

Yes it’s on ETH.

!LUV !PIZZA

@logicforce(3/4) gave you LUV.

Putting HBD in savings earns a 12% APR, is this not as favorable as a liquidity pool because the APR is locked but in a liquidity pool the APR can rise?