FED Does Not Know What It Is Doing.

This post is to elaborate on my discussion with @taskmaster4450le in regards to his post. First off I appreciate taskmaster4450le for correcting my explanation for my Reverse Repo post. In fact I agree with his sentences below as he articulates it accurately which I could not:

This is why the banks take the 3% from the Fed. The reality is they have no choice. Since 2007, the entire global financial system was turned upside down and has cost tens of trillions of dollars in lost GDP.

It is one of the reasons growth rates around the world are completely anemic.

Banks Are Selling US Treasuries

As we are all aware with QT in full swing the FED is selling their US Treasuries holdings. Chart below is showing the gradual sales that has occurred and FED anticipates to continue into end of the year.

(Courtesy of St. Louis Fed)

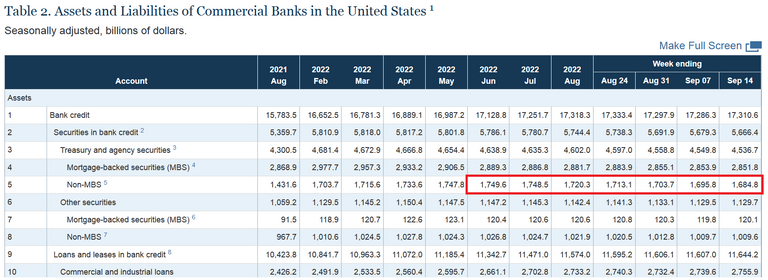

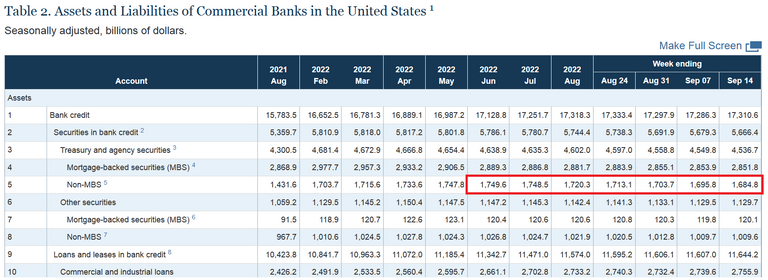

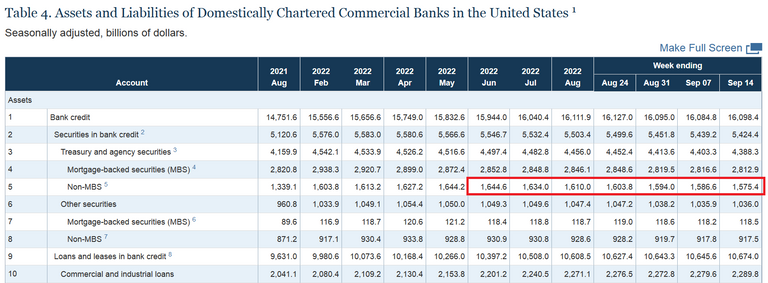

Well if the FED is selling what do you think the banks are doing? I'll get straight to the answer, banks are also selling US Treasuries. The data from the FED itself is providing proof.

Since June 2022 every month the amount of US Treasury held by the US commercial banks have been falling. Same goes for US Chartered commercial banks.

An oddity I like to bring up is within these number charts at first glance it maybe difficult to decipher item 5 being US treasuries but you need to read the footnotes to confirm.

5 . Includes U.S. Treasury securities and U.S. government agency obligations other than MBS.

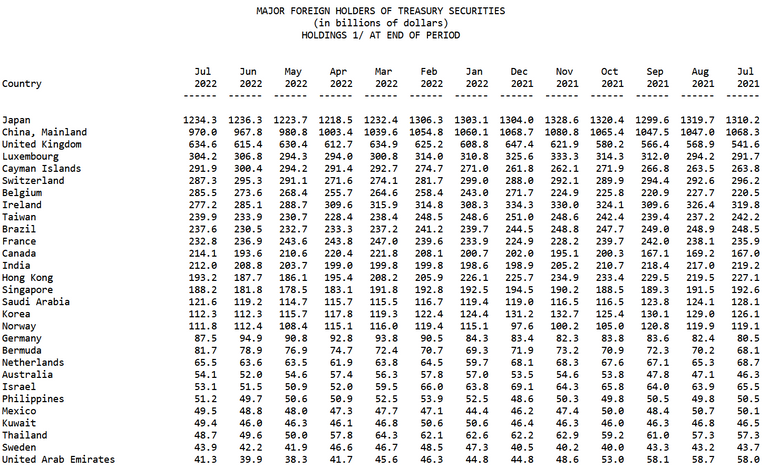

International Countries Buyers of US Treasuries

On the other hand it appears majority of countries outside the US bonds are being bought as the amount has risen. Data from the US Treasury.

Yet then why are bond prices falling?

Bond Prices Falling

So what do we make of these data points? First off the US bonds have been rising rapidly is because they are being sold off. There is an inverse relation with the bond price and its yield. The higher the yield the lower the bond price and vise versa.

(Courtesy of Ycharts.com.)

In the past year short term bond prices have been in a free fall making yields rise as shown in above chart for the 3 month yield. These bond prices drops are across the board. Look at the 20 year bond yields.

(Courtesy of Ycharts.com.)

The bonds selling is so pronounced that even foreign buying is not able to contain interest rates. Yet why is this?

My Personal Opinion

I maybe totally wrong here so what to put out the disclaimer that this is not financial advice. I personally believe that the US banks are well aware that the economy is slowing and as such are trying to save for the rainy day. Banks are hoarding cash as much as they can now in lieu of economic woes.

(Courtesy of Reuter's Article 2022-09-21).

US Congress was meeting with US top banks CEO just this past week and short summary is the banks are in agreement with the FED raising rates. However some of the CEOs also mentioned "We're [US economy] going to be in for tougher times ahead." Proof is in the actions the banks are performing and they seem to be preparing for trouble times ahead.

Conclusions

How the FED operates and its integral part with other central banks are important, but often they are playing into the hands of the banks. The FED benefiting the banks more than to the average American is not only a fleecing of Americans and a transitivity.

The FED is suppose to police the banks in order to control the the stability of the dollar. They have failed countless times since their inceptions and it has only gotten worse over the years. Their actions has cause more harm than help the average American.

With this current move in interest rates it appears the banks are believing its not going to end well and are preparing for what maybe to come. Meanwhile the actions taken by the FED has likely caused the average Americans portfolios to shrink rapidly in the tune of -20% for 2022 whether they were invested in bonds or in stocks. I personally am one of them :/

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

The Fed is incompetent and I completely agree with this fact. They have little control over the rates and if they do have any, it tends to be the shorter-term rates. I still think other countries will buy the bonds but they aren't paying as much due to a higher supply of treasuries/bonds appearing in the market.

I think the banks needs to do its part by lending out money and getting money moving in the economy but they are so fixated on profits. They just think its too risky to lend in the current environment.

Posted Using LeoFinance Beta